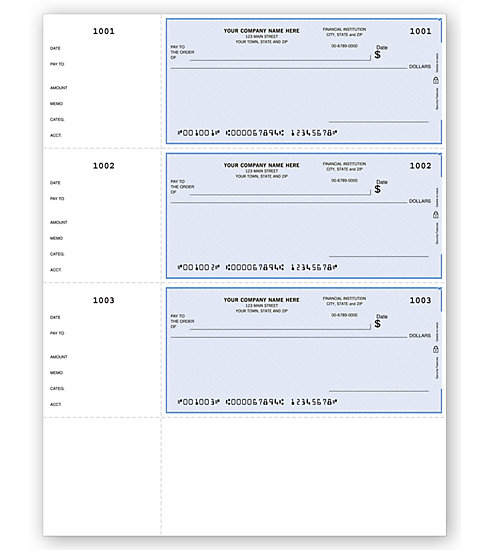

Print Later or Pay Online: If you’d like to print the check at a later date, check off Print Later. Think of it as an optional note you can leave yourself about the reason for the payment.ĩ. Memo: This is an optional field that you can leave blank. Address: The address of the payee, which will fill in automatically.Ĩ. Amount: Enter the amount in numbers, and the amount will be automatically spelled out with words below the Pay to the Order field.ħ. Date: The date you’re issuing the check.Ħ. : The number of the check, assigned depending on the preference you set in QuickBooks.ĥ. If you’ve paid them before, their information should autofill.Ĥ.

Pay to the Order of: Specify the name of the payee the check is being issued for. Ending Balance: The balance of the bank account that will be used as of that day.ģ. Bank Account: Choose the bank account the money will be taken from.Ģ.

These numbers help protect against fraud, and they can be read by both machines and humans. The bank line-the misshapen numbers and characters that run along the bottom of the check-includes the bank code, bank account number, check number, and document-type indicator. Due to a surge in the use of checks, this process became too time-consuming, so it became automated. Before the advent of magnetic ink in the 1950s, all checks had to be processed manually by individuals. The ink is used in conjunction with Magnetic Ink Character Recognition (MICR) technology. Magnetic ink is used primarily by the banking industry to make the processing of checks fast, accurate, and secure.

0 kommentar(er)

0 kommentar(er)